Factoring¶

Factoring Mechanism¶

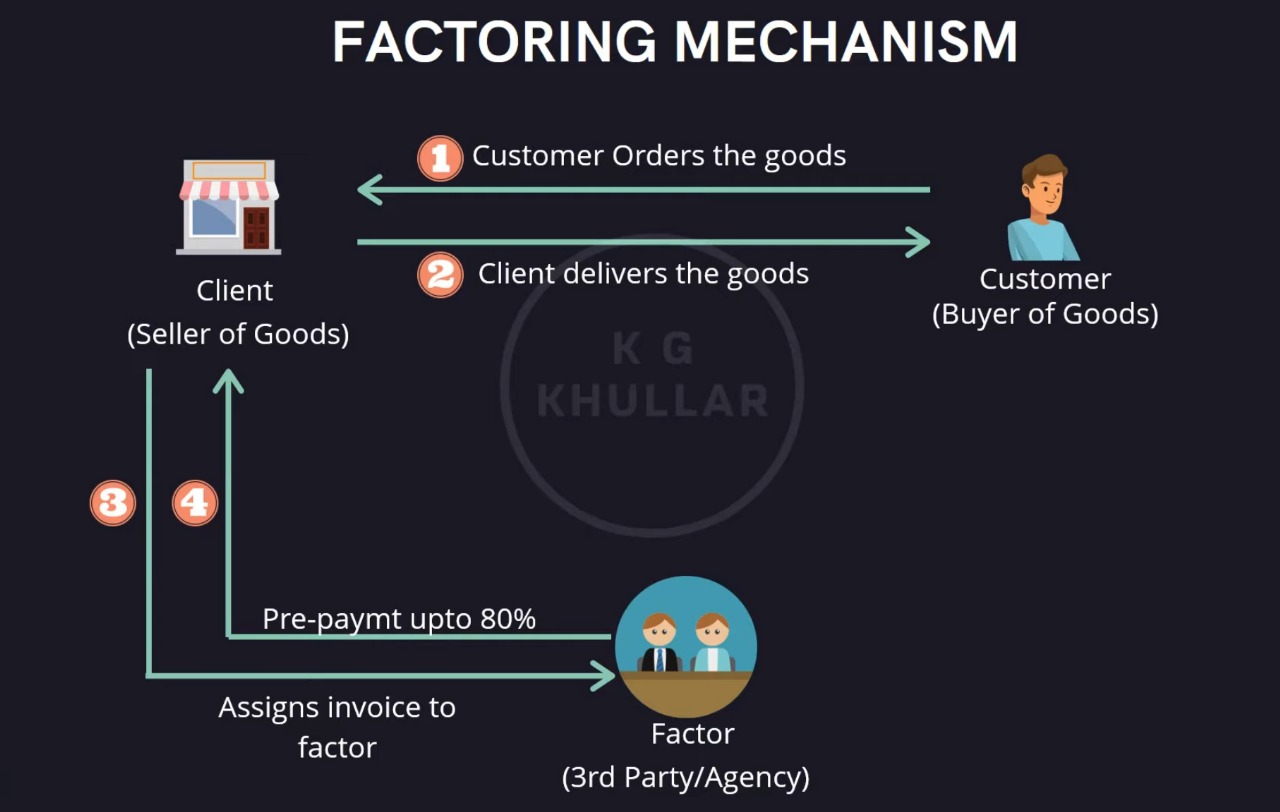

Factoring is a financial service that involves the purchase of accounts receivable by a third party, called a factor, from a business, called a client. The factor pays the client a percentage of the invoice value upfront and the remaining amount minus the factoring commission upon collection from the buyer. The factor also manages the client's sales ledger, handling all sales transactions and collecting funds from the client's debtors. Factoring is a popular financing option for small and medium-sized enterprises (SMEs) that need immediate funds to meet their working capital requirements.

Functions of a Factor¶

- Maintenance of Sales Ledger: The factor manages the client's sales ledger, handling all sales transactions.

- Financing: Factors finance clients by purchasing all account receivables.

- Credit Protection: In non-recourse factoring, the factor bears the risk of non-payment or bad debts.

- Collection of Money: The factor is responsible for collecting funds from the client's debtors, freeing the client to focus on core business areas.

Factoring Process¶

- Seller: Sells goods, raises an invoice, and sends it to the factor for funding.

- Factor: Pays 75-80% of the invoice value upfront and makes the remaining payment minus the factoring commission/fees upon collection from the buyer.

- Buyer: Makes the invoice payment to the factor.

Advantages of Factoring¶

- Reduces credit risk for the seller.

- Improves the working capital cycle by providing immediate funds based on invoices.

- Reduces administrative and collection costs.

- Enhances liquidity and cash flow, aiding in timely creditor payments and better discount negotiations.

- Diminishes the need for new capital injections into the business.

Disadvantages of Factoring¶

- Potential strain on company-client relationships due to the factor's involvement in collections.

- High cost of factoring services.

- Risk of damaging the company's goodwill due to the factor's mishandling of debtors.

- Factors often avoid risky debtors, leaving the burden of managing such debtors with the company.

- Requirement to disclose detailed customer and sales information to the factor.

Different Types of Factoring¶

- Full-Service Factoring: Involves comprehensive services including sales ledger management, statement of accounts to the client, collection of receivables, and credit control.

- Reverse Factoring: Initiated by the buyer/importer for supply chain financing, where the client gets invoice financing upfront, sometimes with fees borne by the customer.

- Disclosed and Non-disclosed Factoring: Disclosed factoring involves informing the buyer about the factoring arrangement, while non-disclosed factoring keeps the buyer unaware of this arrangement.

- Maturity and Advance Factoring: Maturity factoring involves the factor collecting dues and passing them to the client, while advance factoring provides a significant portion of the receivables as an advance to the client.

- Recourse and Non-recourse Factoring: Recourse factoring places the credit risk on the client, while non-recourse factoring puts this risk on the factor.

- International Factoring: Pertains to cross-border transactions involving buyers and sellers in different countries.

Factoring offers businesses a practical solution for managing their accounts receivable and enhancing their financial stability. The choice between different types of factoring depends on the specific needs and risk preferences of the business.