Forfaiting¶

Forfaiting is a financing technique used in international trade where exporters sell their receivables to a forfaiter at a discount in exchange for immediate cash. This method is particularly useful in transactions involving large sums and longer credit terms.

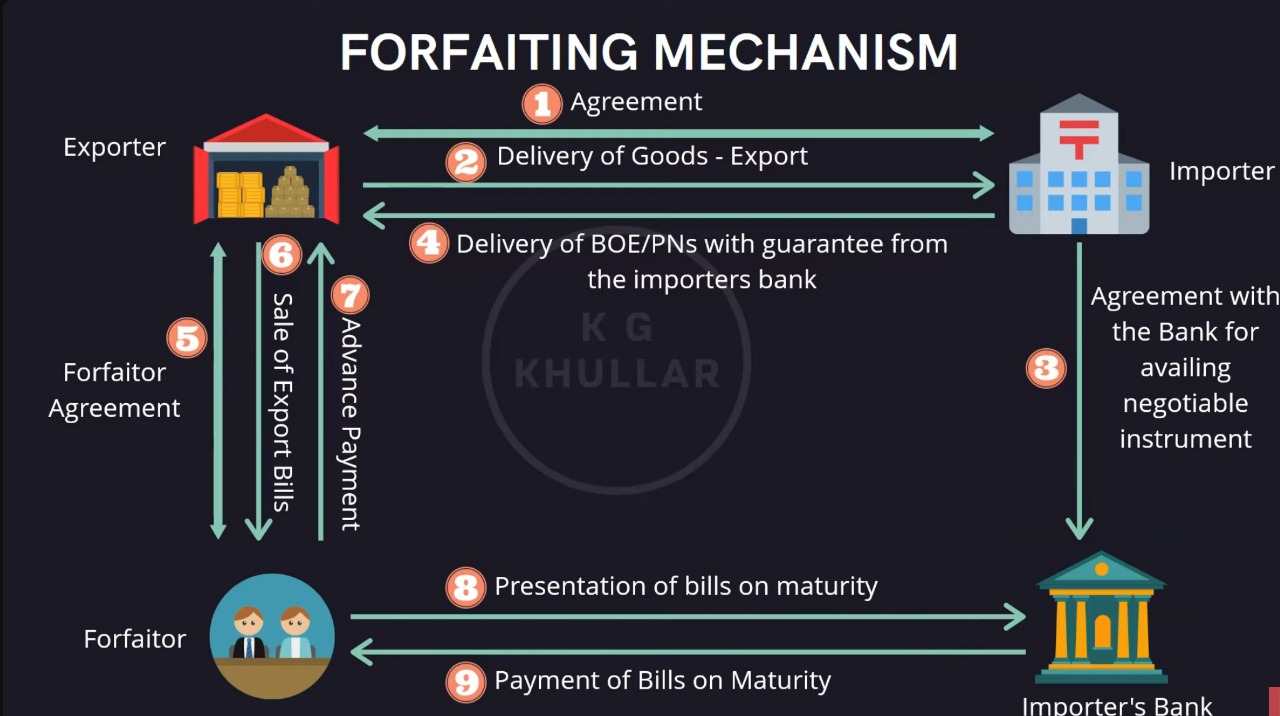

Forfaiting Mechanism¶

-

Agreement: The exporter and importer enter into a trade agreement where the exporter agrees to sell goods to the importer under deferred payment terms.

-

Delivery of Goods - Export: The exporter ships the goods to the importer as per the agreement.

-

Agreement with the Bank for Negotiable Instrument: The importer, to fulfill the payment obligation, arranges for a negotiable instrument such as a promissory note (PN) or bill of exchange (BOE) through their bank. This serves as a formal promise to pay the amount due on the agreed date.

-

Delivery of BOE/PNs with Guarantee from the Importer’s Bank: The importer's bank provides a guarantee on the BOE or PN, backing the importer's promise to pay. This guarantee increases the creditworthiness of the payment promise.

-

Forfaitor Agreement: The exporter enters into an agreement with a forfaiter, a specialized finance firm, to sell the receivables that are due from the importer.

-

Sale of Export Bills: The exporter sells the BOE or PN to the forfaiter, often at a discount. This sale is without recourse, meaning the exporter is no longer responsible for the credit risk associated with the importer's payment.

-

Advance Payment: The forfaiter provides an advance payment to the exporter. This payment is typically a percentage of the face value of the receivables, allowing the exporter to receive immediate cash and improve their cash flow.

-

Presentation of Bills on Maturity: On the maturity date of the BOE or PN, the forfaiter presents these instruments to the importer or the importer's bank for payment.

-

Payment of Bills on Maturity: The importer, or the importer's bank, makes the payment for the full face value of the BOE or PN to the forfaiter on the maturity date, completing the transaction.

Characteristics of Forfaiting¶

- International Focus: Primarily used in international trade finance.

- Large Transactions: Typically involves high-value exports.

- Credit Term: Offers medium to long-term credit to buyers.

- Non-Recourse: The exporter relinquishes the risk of non-payment by the importer once the receivable is sold to the forfaiter.

Forfaiting Process¶

- Exporter and Importer Agreement: An exporter sells goods to an importer under a deferred payment agreement.

- Sale of Receivables: The exporter sells the promissory notes or bills of exchange, representing the importer's debt, to a forfaiter.

- Discounted Purchase: The forfaiter buys these receivables at a discount and pays the exporter cash.

- Collection: The forfaiter becomes responsible for collecting the payment from the importer on the due date.

Differences from Factoring¶

- Scope: Forfaiting is specifically used for international trade, while factoring can be domestic or international.

- Transaction Size: Forfaiting typically deals with larger transaction sizes compared to factoring.

- Credit Term: Involves medium to long-term credits, unlike factoring which is usually for short-term receivables.

- Recourse: Forfaiting is generally without recourse, meaning the exporter is not liable if the importer defaults. In factoring, recourse terms can vary.

Forfaiting provides a secure financing option for exporters in international trade, enabling them to transfer the credit risk associated with foreign receivables to a forfaiter. This method is particularly valuable for exporters who wish to improve their cash flow and eliminate the risks associated with international trade receivables.